utah food tax increase 2020

Utahns experiencing food insecurity and hunger advocates have been vocal about their opposition to the increase which would raise the food tax from 175 to 485 percent saying it could cripple. West Valley City Utah Jan.

2022 Property Taxes By State Report Propertyshark

The West Valley City Utah-based grocer invited customers through Jan.

. Republican 2020 candidate for Utah Governor Jon Huntsman Jr. This graphic shows what this increase means to you. 9 2020 Harmons Grocery is joining in opposing the food tax increase from 175 to 485 by opening its 19 statewide stores for people to come in and.

We appreciate all who have reached out and are grateful for. Utahns experiencing food insecurity and hunger advocates have been vocal about their opposition to the increase which would raise the food tax from 175 to 485 percent. Rohner led a referendum effort to stop the 2019 Utah Legislature tax reform package which would have created a 31 increase on the state sales tax on groceries a.

The same bill that cuts the states already low and flat income tax rate from 495 to 466 will also end the discounted sales tax rate the state has for many years charged for. 21 to sign the 2019 Tax Referendum in opposition to the looming 177 food tax increase. It wasnt that Utahns misunderstood all they have to gain through the tax reform bill lawmakers passed in a special session last month.

The Utah County Commission recently voted to adjust property tax rates. Heidi Rosenberg of Tooele who works in marketing said she signed the referendum on her way into the store because shes concerned about the impact of the sales. 9 2020 Gephardt Daily Harmons Grocery is joining in opposing Utahs food tax increase from 175 to 485 by opening its 19 statewide.

Said I initiated tax reform that reduced the sales tax on food when I was governor which has now been. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Counties and cities can charge an additional local sales tax of up to 24 for a maximum.

Harmons Grocery is joining in opposing the food tax increase from 175 to 485 by opening its 19 statewide stores for people to come in and sign the Utah 2019 Tax. WEST VALLEY CITY Utah Jan. The flat rate income tax dropped from.

How Do State And Local Sales Taxes Work Tax Policy Center

Legislators Propose 75m Tax Collection Reduction But New Taxes On Food Gas Proposed Ksl Com

Cost Effectiveness Of A Sugary Drink Excise Tax In Utah

State Legislators Discuss Raising Utah S Sales Tax On Food From 1 75 To Nearly 5 Kutv

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

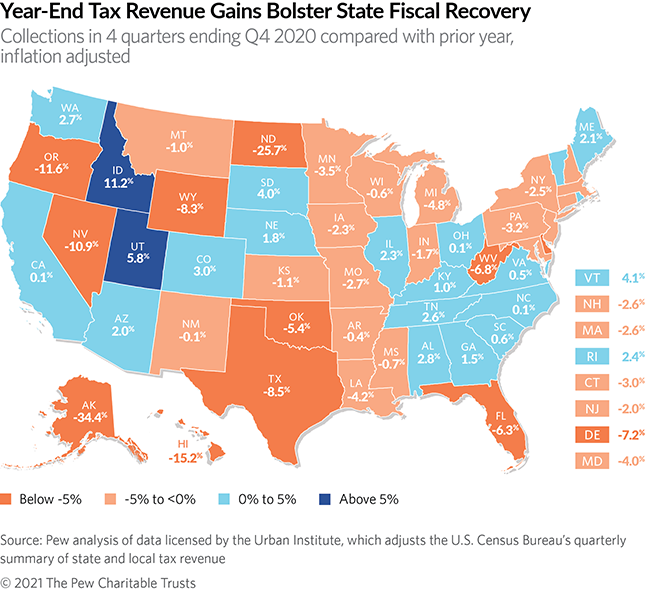

States Close Out 2020 With Widespread Tax Revenue Gains The Pew Charitable Trusts

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

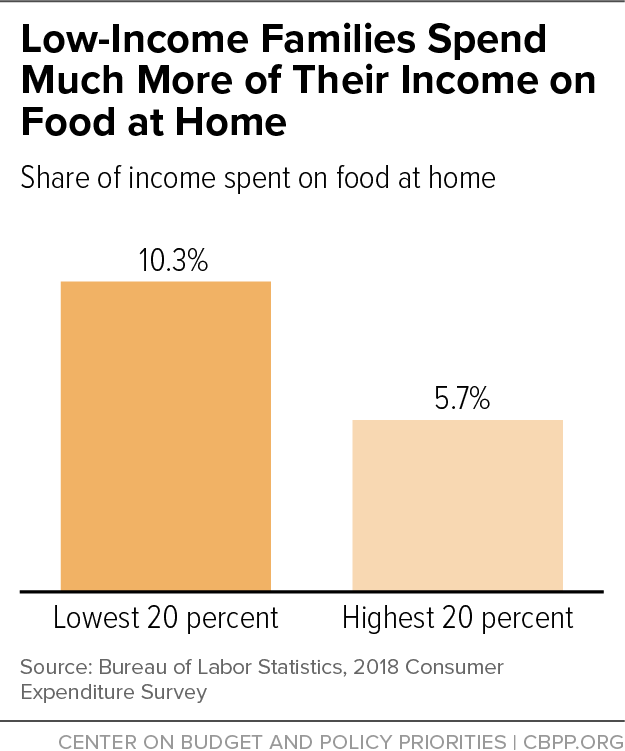

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Is Food Taxable In Utah Taxjar

Sales Taxes In The United States Wikipedia

Referendum Organizers Cheer Repeal Of Utah Tax Reform Law Utah Stories

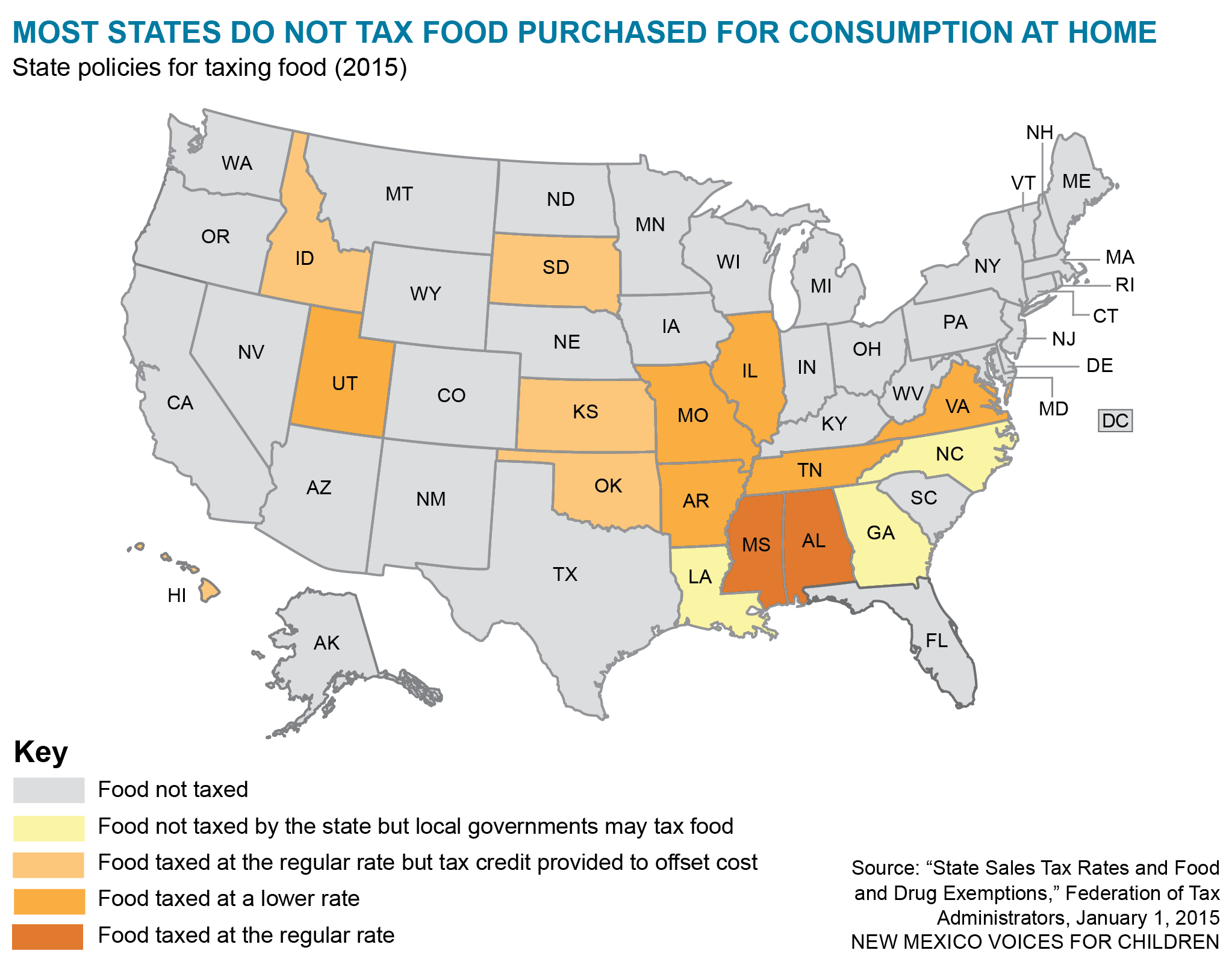

A Health Impact Assessment Of A Food Tax In New Mexico New Mexico Voices For Children

Tooele County School District Bond 2020 Miscellaneous Tooele County School District

2020 Has Another Surprise In Store For Some Utahns A Tax Hike

Utah Sales Tax Rates By City County 2022

State Legislators Discuss Raising Utah S Sales Tax On Food From 1 75 To Nearly 5 Kutv

Travis Campbell For Utah House

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Gop Leaders Propose Dropping Public Education Earmark On Income Tax Deseret News